Top questions and concerns from Retirees

In meeting with pre-retirees and retired clients over the last couple of months the most asked questions and concerns are:

- How long will my money last?

- Will I out live my money or will my money outlive me?

The other questions and concerns are:

- What effects will inflation and higher interest rates have on my long-term income?

- What effects will lump sum withdrawals have on my long-term plan?

- Is the government considering new ideas for long-term planning? YES

- How do I pay for assisted home care and do I have enough money?

- With pandemic concerns, wars, bankrupt financial institutions, political strife how quickly can you adjust our longevity plan?

- Clients are asking approximately how much estate will I leave? And who will that go to? Family, Charity or Canada Revenue?

Retirement income planning in now considered one of the biggest challenges people face once they decide to retire.

There is nothing similar between retirement SAVINGS and retirement SPENDING.

What is your plan in regards to decumulation of your monies? Very few clients have an actual retirement income plan.

I have added a new software program called RazorPlan that addresses decumulation of people’s money for retirement. This program is being used by high-net-worth clients, top Canadian banks and insurance companies. I have reviewed many plans over the years for your situation and I feel RazorPlan gives us much more needed information for the long term. No one client has the same needs as another. We are using this Focused Plan to create value over product. This is called YOUR Retirement Readiness Number. I’m currently putting together illustration plans for existing clients. Showing clients how to implement this program using your numbers, your wishes and your questions.

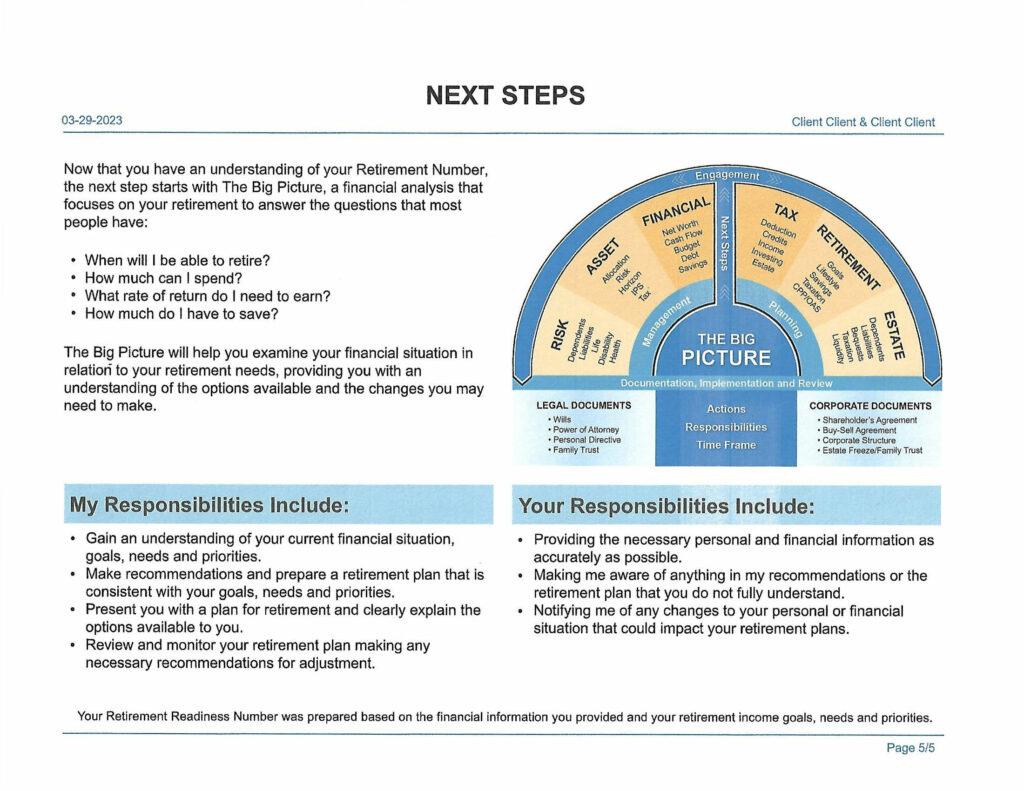

Once we calculate your Retirement Readiness Number we use that knowledge to determine the next steps (illustrated in the example below – view a larger version of the image here)

Benefits of the RazorPlan software:

- This is a new optimization tool for a new decumulation phase of a client’s life

- It provides an unbiased recommendation on how to reduce the risk of outliving your money while achieving after tax lifestyle and estate goals

- Key features: automatically determines the optimal retirement withdrawal strategy to either maximize the estate or maximize retirement income

- Compares optimal strategy to conventional strategies of drawing down from registered first, non-reg first or TFSA first. This program compliments the existing retirement and estate planning strategies created in RazorPlan.

When we get to the decumulation stage, it’s time to change our thinking!!!

This program gives you a unique approach to financial planning. Since we can’t predict the future, we don’t know what scenarios will unfold but we do know that there are more options for longevity planning!

I too, am a retiree and live in a world of Reality and not Speculation.

I highly encourage you to review this current decumulation plan for retirement.