I hope everyone is enjoying summer!

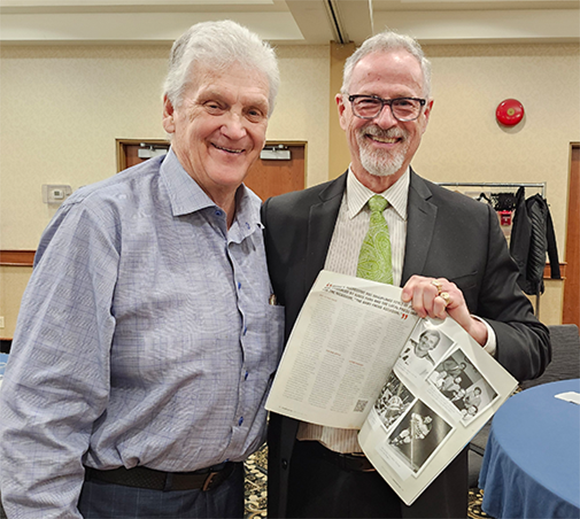

I’m humbled to share that a wonderful surprise has been given to me.💗

I was chosen to be an inductee for the Manitoba Sports Hall of Fame. It is a great honour being in the company of amateur and professional athletes, coaches, executives, medical teams and a first-time Special Olympian athlete – whether it be professional or amateur, I’m proud to be included in this group.

I was previously honoured to be selected for the Manitoba Hockey Hall of Fame in 1985. Thanks to my family and all who have supported me over the years.

Now onto this month’s class…

My questions:

How to take into consideration the affects of:

- politics

- stock volatility

- government involvement in future taxation

- higher interest rates than ever before

- general volatility around the world

Most importantly,

YOUR questions:

- Is my current budget realistic?

- What are the affects of inflation on my income and future costs?

- How to plan for the rising costs of property taxes, home insurance, gasoline and food?

- Where am I going to live in the future (home care? assisted living?)

- Do I leverage home equity for future living costs?

- How does a life lease work?

- How do I budget for my condo’s future maintenance costs?

- If I advance money for intergenerational planning (for children and grandchildren) will this result in a surprise emergency lump sum?

These are good questions, especially:

Where will the money come from?

There is good news:

We can measure ALL of these numbers for you!

We use a program called RazorPlan that’s capable of building long-term illustrations to address some of the above questions/scenarios. We are finding that this plan should be reviewed semi-annually or annually because in retirement, money and health situations can change very quickly for you and your family.

Call us at 204-774-9529 or schedule a time online: calendly.com/tedirvine

Seeing your plan helps!

Once Clients/Retirees can see and review their legacy or estate plan, they feel comfortable with how much money they have left and what will be dispersed to family, grandchildren, charity and Canada Revenue Agency (CRA)/Trudeau.

In retirement, asset decumulation strategy is very complex.

Having a portfolio with a draw down plan is very important. As part of my ongoing development, the latest book I’m reading is by Fred Vettese – author of “Retirement Income for Life”. His thoughts are drawing down one’s savings in retirement is something very few retirees do well, even with the help of professional advisors.

But help is here for you! As one retiree recently said to us:

“Thank you for this longevity plan.”

They feel that their wishes are being heard.

This is your plan not somebody else’s plan.

Professor Ted says let’s put all your numbers and thoughts down on paper.

Please enjoy your summer and I will sit in the shade and create your wishes!!

Summer class dismissed!😊

Ted’s Resources

Curious? I invite you to browse my ongoing library/references:

→ Financial Independence Work On Own Terms (FIWOOT)

→ RazorPlan

→ Fred Vettese

→ CapIntel

→ TedIrvine.ca

→ Forward this eNews to someone you’re close with